How to effectively apply real estate tax over time of ownership?

Market news

15/02/2025

In the draft Law on Personal Income Tax (replacement), the Ministry of Finance proposed to regulate tax rates for income from real estate transfers based on the duration of property ownership, with the shorter the duration, the higher the tax rate, in order to prevent real estate speculation.

The current personal income tax policy does not distinguish between the duration of real estate ownership of the transferor. This, according to the Ministry of Finance, makes short-term real estate speculation, surfing, and profit-making transfers common because there are no strong sanctions. Regulating tax rates based on the duration of property ownership will prevent real estate speculation.

Speaking to VnExpress, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, agreed with the application of tax as a tool to prevent speculation, surfing, abandonment of assets, land waste, and instability for the healthy development of the market. However, if calculating the tax based on the holding period to eliminate the benefits from speculation and regulate the market, according to Mr. Chau, it should only be applied at a time-based basis, specifically when the market is unstable and hot. When the market is stable and sustainable, there is no need to apply this tax.

Real estate in the East of Ho Chi Minh City, Thu Thiem peninsula area. Photo: Quynh Tran

He said that many years ago, when the real estate market was constantly experiencing a real estate fever, the Association proposed a measure to impose a real estate transfer tax over time to cool down the speculative wave. If the real estate transfer transaction has a holding period of less than 6 months, the tax rate is 5%, 6-12 months is 4%, over 1-2 years is 3%, after 3 years the current tax rate of 2% is still applied.

However, according to him, the most effective solution is to soon complete the real estate tax law, including taxes for people who own many real estates, abandoned real estate tax, transfer tax... to have specific sanctions, reducing the waste of real estate resources.

From the perspective of businesses, Mr. Dinh Minh Tuan, Director of Batdongsan in the Southern region, said that real estate speculation is an aspect of the market and is difficult to completely eliminate. The nature of speculation is to take advantage of a shortage of supply in an area or segment, high demand, to buy and sell quickly at high prices. This activity is strong and difficult to control, especially when the market is hot.

Therefore, Mr. Tuan believes that there should be a phased approach when applying taxes based on the time of holding real estate. If the market is hot, in the short term, the above tax will effectively reduce the benefits from speculation. In the long term, a tax rate of a few percent is not the main factor that stops speculative activities. Supply and housing prices are the key to reducing speculation and surfing.

"If supply is abundant and prices are affordable, no one will be excited to speculate in land," said Mr. Tuan.

Economist Huynh Phuoc Nghia, Director of the Center for Economics, Law and Management at the UEH School of Economics, Law and State Management (Ho Chi Minh City University of Economics), suggested that instead of applying this type of tax to the entire market, the government should calculate it according to each type and each market to avoid creating a widespread impact. Applying many types of taxes at the same time can easily lead to a decrease in liquidity and high housing prices.

Mr. Nghia said that the government should consider applying taxes to real estate products serving real housing needs such as townhouses and apartments to limit speculation in these types. In addition, in localities and areas with high residential demand such as industrial parks, export processing zones, and large cities, the government can also consider taxing according to ownership time.

However, the progressive tax policy also needs to be consistent and reasonable, combined with high taxes for groups that own many real estates (3 or more properties) and abandoned houses and land...

Experts agree that Vietnam can rely on the experience of other countries to come up with a direction for using tax tools to cool down housing prices, regulate the market to develop more healthily and effectively. However, this solution needs a specific roadmap on the time of application, criteria, tax rates... to avoid causing shock to related parties.

In addition, if high taxes are imposed on real estate with short holding periods, there should also be a policy to reduce taxes for real estate transactions with long-term ownership periods, tax incentives for first-time home buyers and a policy to lower the regulatory tax rate when the market "freezes" to create fairness and encourage real estate purchases.

According to research results from Batdongsan, more than 86% of buyers in Vietnam in the past 5 years have been for speculation, surfing, and only holding the property from the time of purchase until transfer within a maximum of one year. This unit believes that the reason for the high rate of real estate speculation in Vietnam is partly due to lower real estate income tax than in the region and the lack of sanctions against land speculation and abandonment.

Meanwhile, the Ministry of Justice believes that the solution of collecting taxes based on holding time is not feasible because the state management of taxes and land in Vietnam is not synchronous.

This agency believes that the application of personal income tax policy for transfers based on holding time needs to be synchronous with the process of perfecting policies related to land, housing, and the readiness of information technology infrastructure for land and real estate registration.

As Vietnam has not yet synchronized state management between taxes and land, the Ministry of Justice believes that this proposal is not feasible and suggests that the drafting agency continue to study it.

Currently, there are 5 basic taxes for real estate in the world: ownership tax, income tax, registration tax, vacancy tax (tax applied to real estate that has not been used for a long time) and development tax (development of infrastructure, utilities, services, in an area where the real estate is located). The average home ownership tax in many countries is 0.3-20%, registration tax is 2-6% and income tax is 14-45%. Some countries are taxing vacant property from 12-20% and development tax is 1-3%.

In Vietnam, home buyers currently only have to pay 3 types of taxes: income tax (2%), ownership tax (0.03-0.2%) and registration tax (0.5%). The proportion of real estate tax in Vietnam's GDP structure is 0.03%, much lower than many countries in the region such as Indonesia 0.2%, Thailand 0.2%, Philippines 0.5%, Cambodia 0.9%, China 1.5%, Singapore 1.5%, South Korea 4%.

A recent survey by VnExpress with nearly 32,000 readers showed that nearly 70% agreed with the tax on second and abandoned real estate. The housing tax policy has been proposed many times over the past 15 years but so far remains "on paper" due to concerns about strong impacts on the market and "lack of political determination".

Phương Uyên

Get the latest information !

Receive the latest market information sent via email week

Featured news

Articles on the same topic

Dù chỉ mới xuất hiện vài tháng ở Khánh Hòa nhưng hoạt động làm tranh mosaic (tranh ghép mảnh) đã thu hút rất nhiều bạn trẻ tham gia. Trải nghiệm mới mẻ này giúp các bạn trẻ rèn luyện sự tỉ mỉ, kiên nhẫn và thỏa sức sáng tạo.

19.08.2025

Thủ đô Bangkok, Thái Lan, đứng đầu danh sách các thành phố tốt nhất thế giới 2025 dành cho gen Z nhờ sự sôi động, là nơi lý tưởng để gặp gỡ bạn bè và giá cả phải chăng.

19.08.2025

Giá vàng hôm nay (18/8): Trong khi vàng miếng SJC duy trì ở mức kỷ lục 124,5 triệu đồng/lượng, giá vàng nhẫn các thương hiệu trong nước ngày 18/8 dao động quanh ngưỡng 116 – 120 triệu đồng/lượng, thấp hơn vàng miếng nhưng vẫn ở vùng cao lịch sử.

18.08.2025

Du khách có thể đi chợ đêm, ngồi bar rooftop ngắm thành phố, tắm biển đêm hoặc tham gia tour câu mực khi đến Nha Trang vào buổi tối.

18.08.2025

Hòn Bà là một ngọn núi thuộc địa phận 2 xã: Khánh Phú, huyện Khánh Vĩnh và Suối Cát, huyện Cam Lâm (cũ) thuộc tỉnh Khánh Hòa, cách trung tâm thành phố Nha Trang khoảng 50km về phía tây nam. Đỉnh núi có độ cao 1.578m so với mực nước biển. Cung đường lên đỉnh núi dốc quanh co, sương mù bao phủ khiến du khách cảm nhận được sự hùng vĩ của đất trời nơi đây.

12.08.2025

Trang tin hàng không quốc tế Routesonline vừa có bài viết giới thiệu Nha Trang, Khánh Hòa từ là thiên đường du lịch đến đô thị vịnh đẹp, đáng sống, hiền hòa và hạnh phúc.

09.08.2025

Nếu đang tìm nơi yên tĩnh để nghỉ ngơi cuối tuần, ba điểm đến hoang sơ như Bích Đầm, làng chài Ninh Vân và công viên đá Ninh Thuận là lựa chọn lý tưởng.

09.08.2025

Nha Trang không chỉ dành cho những ai có ngân sách thoải mái. Chỉ với 2 triệu đồng, bạn vẫn có thể tận hưởng một chuyến đi đáng nhớ với biển xanh, ẩm thực phong phú và những trải nghiệm văn hóa thú vị.

30.07.2025

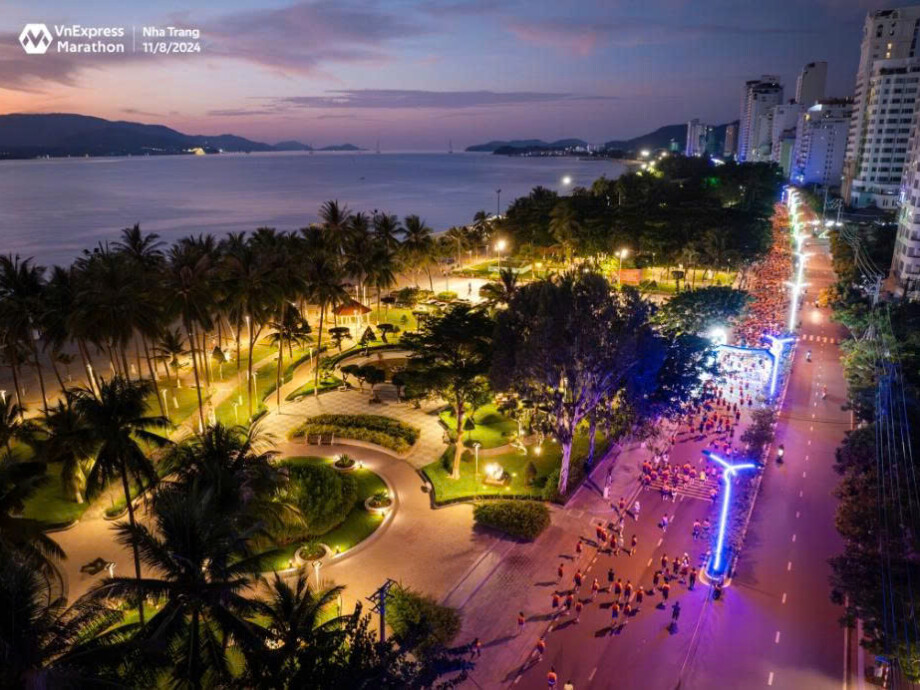

Không chỉ nổi tiếng với du lịch biển, Nha Trang dần trở thành điểm đến lý tưởng cho giới chạy bộ, nhờ môi trường luyện tập, nghỉ dưỡng và trải nghiệm văn hóa đặc sắc.

23.07.2025

Lễ hội du thuyền, dịch vụ ghép tour cao cấp, giải marathon quy mô 13.000 người... góp phần giúp du lịch Nha Trang khởi sắc hè này.

19.07.2025

Typical projects

50-70 million/m2

50-70 million/m2

48 triệu/ m2

50-70 million/m2

50-70 million/m2